The 2008 financial crisis was caused by the granting of high-risk mortgage loans to borrowers with low repayment capacity, the expansion of the real estate bubble, the overvaluation of financial assets, and the lack of adequate regulation of financial markets.

The US took measures to stabilize the economy, such as the rescue of financial institutions, economic stimulus, regulatory reform, monetary policy, and aid to homeowners.

SVB, era un banco comercial enfocado en un sector específico y no estaba tan expuesto a los activos tóxicos como Lehman Brothers.

Regarding the measures adopted by Biden, US regulators announced a plan to protect deposits at Silicon Valley Bank in California and Signature Bank in New York.

What caused the 2008 financial crisis?

The 2008 financial crisis was caused by a series of interrelated factors that led to a collapse in the US real estate market and the contagion of problems to other financial markets. Firstly, there was an increase in the granting of high-risk mortgage loans to borrowers with low repayment capacity, known as "subprime," which were sold as complex financial assets known as "mortgage-backed securities" (MBS) and "collateralized debt obligations" (CDO).

These complex financial products were widely marketed worldwide, but they were not adequately evaluated in terms of risk and credit quality.

Secondly, the expansion of the real estate bubble in the US led to an increase in housing prices and an increase in the supply of new homes. However, the supply exceeded demand, which led to a decrease in housing prices and an increase in foreclosures.

Thirdly, the overvaluation of financial assets was exacerbated by the excessive use of leverage by banks and other financial institutions, which means they took out large loans to invest in assets. When mortgage-backed securities and other assets began to lose value, banks and other financial institutions experienced large losses and a lack of liquidity.

Finally, the lack of adequate regulation of financial markets, as well as the lack of effective supervision of financial institutions, allowed these risky practices to continue and spread to other markets. The collapse of Lehman Brothers in September 2008 was the culmination of the financial crisis, and its contagion effect caused a severe global economic recession.

What measures did the US take during the 2008 financial crisis?

The US government implemented a series of measures and strategies to try to stabilize the economy and address the 2008 financial crisis. Some of these measures included:

- Rescue of financial institutions: The government implemented a $700 billion financial rescue plan known as the Troubled Asset Relief Program (TARP) to help institutions in danger of bankruptcy

- Economic stimulus: The government implemented economic stimulus measures, including a $787 billion public spending package and tax cuts to stimulate the economy.

- Regulatory reform: The government passed the Dodd-Frank Wall Street Reform and Consumer Protection Act in 2010, which established new regulations for financial institutions and protected consumers from deceptive financial practices.

- Monetary policy: The US Federal Reserve reduced interest rates to historically low levels and launched a series of bond-buying programs to provide liquidity to the market.

- Help for homeowners: The government launched a mortgage loan modification program known as HAMP to help homeowners avoid foreclosure.

These strategies helped stabilize the economy and prevent an even greater financial crisis, although the impact of the crisis was felt for many years afterwards.

Diferencias entre SVB del Lehman Brothers

These are very different cases, while SVB was a commercial bank focused on a specific sector and was not as exposed to toxic assets as Lehman Brothers, Lehman Brothers was a global investment bank with significant exposure to mortgage-backed securities and other risky assets, which led to serious consequences during the 2008 financial crisis.

In reality, the SVB case only shares a similarity with what happened in 2008 with Lehman Brothers. In both cases, the lack of supervision by competent agencies allowed too much leeway in their operations. The rest is bad practices in the pursuit of greater profitability.

"This is not 2008," what measures has Biden taken in response to the financial crisis?

Recently, the Department of the Treasury, the Federal Reserve (Fed), and the Federal Deposit Insurance Corporation (FDIC) announced a plan to protect deposits at California's Silicon Valley Bank and New York's Signature Bank.

US regulators will return 100% of deposits to all Silicon Valley Bank clients following the bank's bankruptcy.

The FDIC will guarantee all deposits of the bank's clients, and even beyond the legal limit of $250,000. The money used to guarantee the deposits of these institutions will come from a guarantee fund contributed to by US banks. The White House spokesperson has emphasized that this money will not come from taxpayers' pockets.

90% of Signature Bank's deposits are uninsured, and 20% of its capital is in cryptocurrencies.

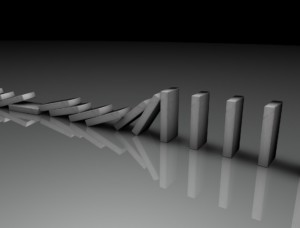

This decision seeks to avoid the contagion effect. And it is especially important for the second domino: Signature Bank. 90% of its deposits are uninsured by the FDIC. It is a bank similar to SVB, meaning it has invested heavily in tech startups and cryptocurrencies. In fact, 20% of its capital is in cryptocurrencies.

Biden ensures that they will do what is necessary to ensure that the intervention of Silicon Valley Bank "does not affect other countries."

Biden said that "Americans can rest assured, the US financial system is safe," that "deposits are secure," and that they will "guarantee" that "they will do what is necessary to ensure that this does not affect other countries."

For corporate finance advisory services, please contact PDV-a.com.

References

The Federal Reserve System is the central bank of the United States | SBV: Silicon Valley Bank | Gestión de contenidos | Online Business Valuation

Leave A Comment