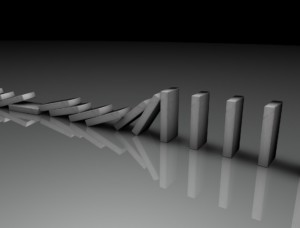

Historically, the Fed's tightening cycles often end up in bankruptcies or financial crises,

Raising doubts about whether there will be something else "breaking" after the fall of SVB.

The credit will shrink as a result of what happened.

Fear of SVB has caused sovereign bonds to gain up to 3% in three days.

SVB's intervention puts fintechs and their regulation in the spotlight. Meanwhile

Big tech companies like Paypal, Adien, or SoFi are skyrocketing on the stock market.

A year ago, the Federal Reserve began raising interest rates, and the SVB bankruptcy has become the first sign of how rate hikes can affect the economy. Historically, every time the Fed starts a rate hike cycle, something happens, and it is not always positive. Nevertheless, the financial system has control mechanisms and capital cushions that reduce financial risk and increase the likelihood of negative effects being minor. However, the SVB bankruptcy is causing a reassessment of the Fed's next moves.

Despite the fact that the economy was showing remarkable behavior with companies with higher-than-expected earnings and profitability levels and a low level of loan defaults, the deposit flight and banking panic suffered by SVB demonstrate that economic policy and financial regulation have been inadequate. The Fed has the difficult task of combating inflation while shoring up financial instability.

According to the Federal Reserve Chairman Jerome Powell's speech to Congress, the financial situation of US banks seemed solid. However, the SVB bankruptcy has cast doubt on his statement. The Fed has broken many things in its history, and today, with new technologies, its movements spread rapidly. It is time for our policy formulation and regulation framework to respond.

The chart shows that most Fed rate hike cycles end up with something breaking in the financial system, from the 1929 stock market crash to bankruptcies, the 1987 Wall Street Black Monday, and the subprime mortgage crisis in 2007, a prelude to the global financial crisis. The Fed has an uncomfortable position, as it must combat inflation and, at the same time, shore up financial instability.

Until last week, apart from a sharp slowdown in the real estate sector, the economy and the financial system had shown few evident side effects of the Fed's aggressive campaign to raise rates during the past year. Now, however, the seams are starting to show. "We've always said that the only thing that could derail Fed tightening would be a financial crisis. It's not clear if a crisis has been avoided yet."

t this stage of the interest rate cycle, some banks will come under pressure, and the Fed must accept it. The Fed has raised rates from zero to near 5%, which implies greater sensitivity to rate hikes when starting from zero rates (think of duration). If some balance sheets are eroded by a reduction in market valuations and turn into monstrosities, before we know it, we'll be facing a crisis.

In summary, the Federal Reserve's interest rate hikes in the United States are having effects on the economy, as demonstrated by the Silicon Valley Bank's bankruptcy. Although the financial system has control mechanisms to reduce financial risk, the financial situation of US banks does not seem solid. The Fed has the difficult task of combating inflation and shoring up financial instability.

Most Fed rate hike cycles end up with something breaking in the financial system, from the 1929 stock market crash to the global financial crisis.

At this stage of the interest rate cycle, some banks will come under pressure, and the Fed must accept it.

For corporate finance advisory services, please contact PDV-a.com.

References

The Federal Reserve System is the central bank of the United States | SBV: Silicon Valley Bank | Gestión de contenidos | Online Business Valuation

Leave A Comment